Saving - Home and Business owners. Time, Money & Stress for over 18 years.

- Rendition with Exemption

- Inventory - Raw, Cost, Completed

- Depreciate Equipment & Assets

- Over 65 and Homestaed Exemptions

- Protest High Notice of Appraised Value Notice

Valley Property Tax Consulting service for Cameron and Hidalgo County.

Many businesses listed below saved $5,000 to $50,000 in tax dollars the first year of using my service.

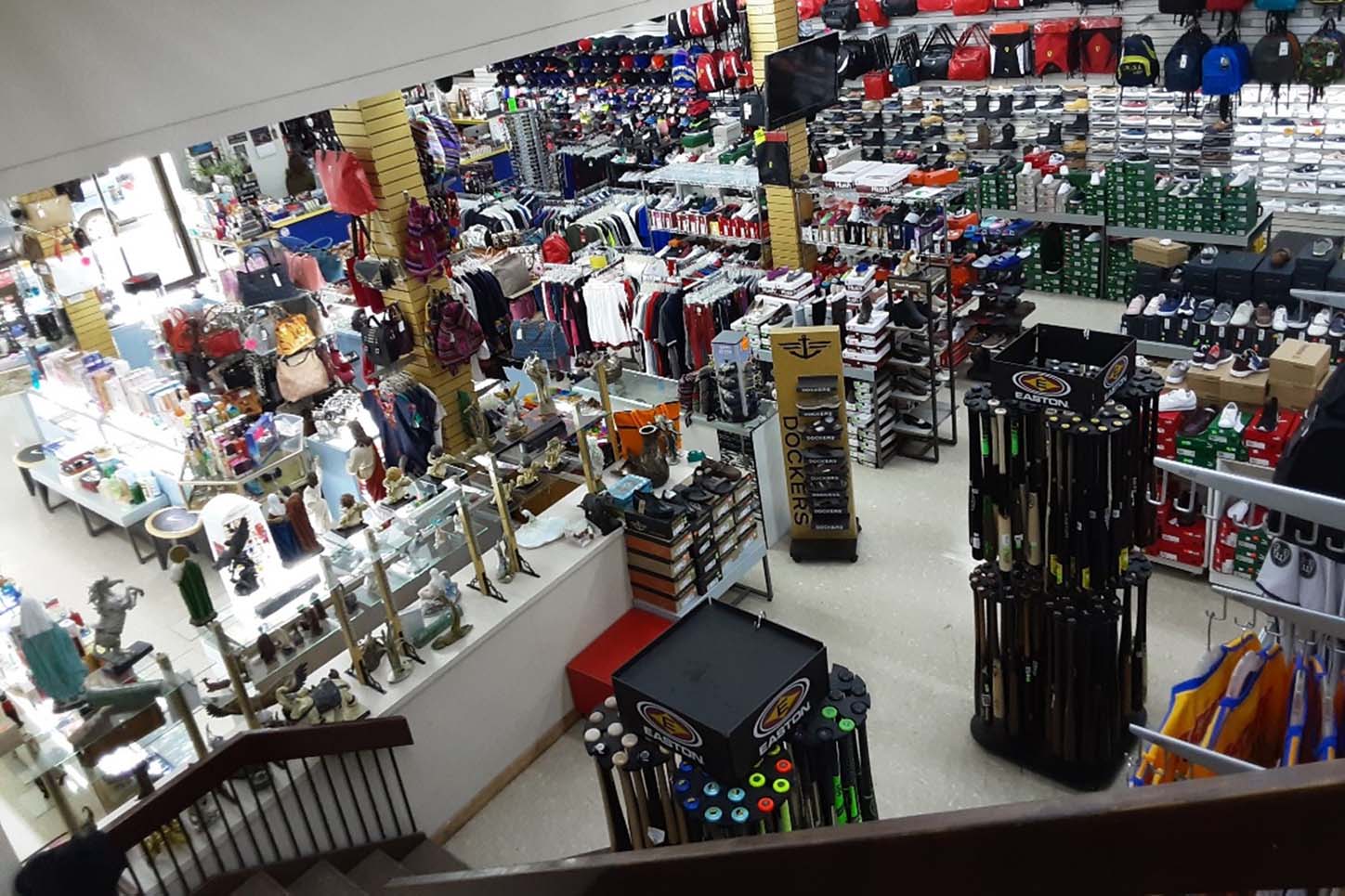

Condominiums, Commercial Buildings, Office/Retail Plaza, Textile Manufacture, Trucking Company, Construction Company, Waste Management Company, Marine Industry, Shrimp boats, Restaurants, Convenience Stores, Pawn Shop, and more. I have prepared Business Personal Property- Renditions for small local family-owned businesses, and also large Multimillion-Dollar businesses.

SUCCESS STORY: 2016 and 2017

After one of the largest local businesses filed for bankruptcy. I was honored to be chosen to work with Restructuring Officer, District Bankruptcy Court. Work needed to be done quickly at the County Appraisal District; filed correct renditions, removed wrong and double taxed assets, correctly depreciated millions of dollars’ worth of equipment, applied for wavier of penalties and exemptions. Ended with tax liability reduction of $200,000, which helped pay local vendors unpaid claims. More good news: business was purchased and put back into operation creating jobs.

Let's get started on saving you Time, Money and Stress.

Property tax solutions for you at your local County Appraisal District.

Most business owners are challenged with 2 types of property taxes. BPP- Business Person Property and RP- Real Property

Property Tax Time will be your Property Tax Department just like the big companies.

Call 956-346-5719 Today.

Specializing in Preparing, Filing & Negotiating your Business Personal Property – Renditions, Protest of Commercial Taxable Values and Apply for Exemptions that save you money.

PROPERTY TAX DEPARTMENT

Commercial Real

Property

2 Types of Real Property

- Land Value

- Improvements Value

3 Types of Value Approach

- Comparable Sales

- Income

- Cost Build + Ratio Factor

Exemptions save money

Most application are due in April, but a few are due earlier.

A win win situation.

No upfront cost.

Performance based fee %. The more I save you, the more I earn.

Business Personal Property - Rendition

Business Personal Property “BPP” – Rendition.

Correctly filing your Rendition could save you a lot of money.

My approach works.

To Preparing a Rendition

- Physical evaluation of all assets, equipment and inventory.

- Never give your business asset depreciation statement as a Rendition. It is used for purchase date and amount of purchase.

- Many items on asset depreciation statement are obsolete, trash or sold. Needs to be Correctly Adjusted.

- List all Assets & Values.

- Negotiate w/ CAD staff.

Depreciated and Allocated Values

Allocated Values

Mostly apply to Semi Tractors and Trailers, Planes, Boats.

That often travel across State or International boundaries.

Depreciation

IRS and County Appraisal Districts have deferent Depreciation Schedules of values.

Appraisal District -have a minimum depreciated value between 8% to 34% of its original purchase price.

IRS- filing of asset value can depreciate to $0 over years.

Some Appraisal District will tell you to give them your Asset and Depreciation statement as a Renditions. Never Do This, Call me first.

Welcome to Property Tax Time – Your Trusted Property Tax Reduction Consultant!

Are you a business owner or real estate investor who is paying unfair high property taxes? If so, you’re at the right place! Alan Atherton is a Texas licensed Senior Property Tax Consultant with over 17 years of experience. Specialized in helping clients reduce their property tax liability at the local Cameron County Appraisal District, Specialized in preparing Business Personal Property – Rendition inventory taxes, Income producing real estate property and Commercial / Industrial properties .

Property Tax Time, offers personalized guidance with a tailored approach to achieve the best possible outcome. A consultant with an understanding of the local tax system and know how to navigate the local property tax system.

By using the Texas Property Tax code correctly Alan Atherton owner of Property Tax Time has helped clients in a variety of industries and properties, including condominiums, commercial buildings, office/retail plazas, textile manufacturers, trucking companies, construction companies, waste management companies, marine industry, shrimp boats, restaurants, convenience stores, and pawn shops.

You are looking for real results when it comes to your property tax burden relief. That’s why I am proud of my service. Helping taxpayers reduced property taxable values by millions in taxable values. This has saved many clients between $5,000 to $50,000 on their property taxes in the first year of using my service. That’s real money that never left your bank account, and it’s just one of the reasons why Alan Atherton with Property Tax Time is the premier property tax consultant in Cameron County.

If you’re ready to save Time, Money and Stress on your property taxes, give us a call today at (956) 346-5719 for a consultation. Ready to help you navigate the local tax system and get the best possible outcome. I am confident that you’ll be satisfied my personalized approach.

Thank you for choosing Property Tax Time – your trusted property tax reduction consultant!

James Alan Atherton, is a Texas- Registered Licensed, Senior Property Tax Consultant.

Note: Anybody that offers you a service like this for a fee must be a Texas- Registered Licensed, Property Tax Consultant. By law they must have this on any written contract: “Regulated by The Texas Department of Licensing and Regulation. P.O. Box 12157, Austin Texas 78711, 1-800-803-9202, 512-463-6599; website: www.tdlr.texas.gov/complaints/. “